In order to effectively improve your credit, you must first know what makes up a credit score.

First, let’s define what a credit score is. A credit score is a three-digit numerical value (typically ranging from 300-850) generated by a complex algorithm to determine how likely a consumer is to pay back a debt.

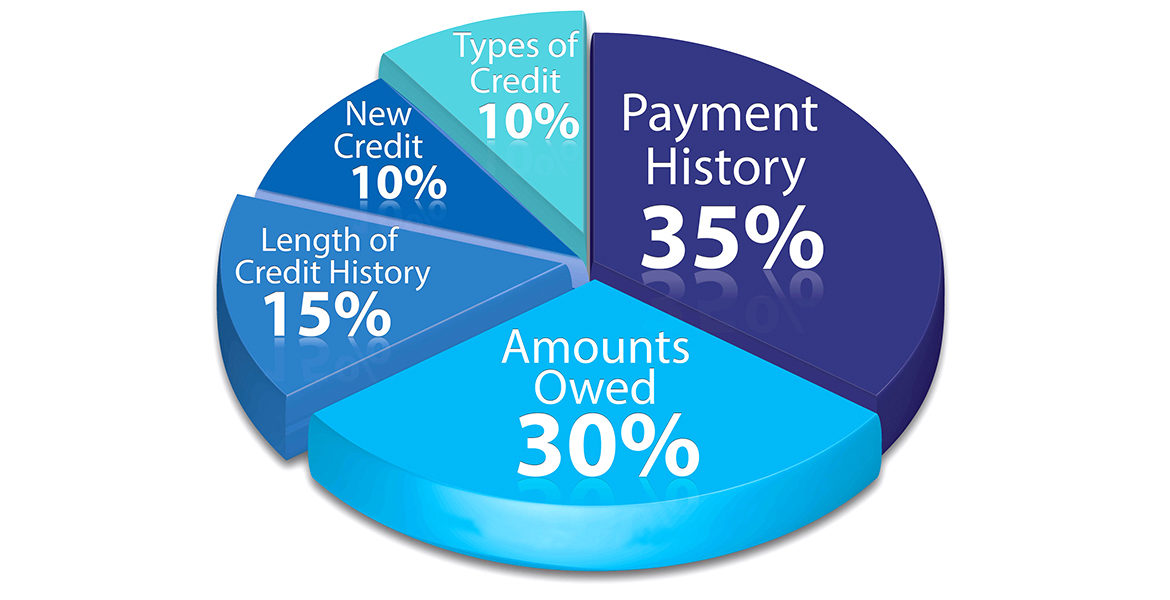

There are 5 major factors that make up a credit score:

- Payment History, or the record of your past payment patterns, is the heaviest weighted credit factor – making up 35% of your credit score. This category also takes into account items like charge-offs, collections and public records.

- Credit Utilization, or the ratio of your debts to available credit, is the second heaviest weighted factor – making up 30% of your credit score. The lower your utilization rate, the better your score.

- Credit Age, or length of credit, accounts for 15% of your credit score. The FICO® scoring model considers your oldest account, your newest account, as well as the average age of all of your accounts.

- Credit Diversity, or credit mix, refers to the diversity of accounts on your credit profile. Lenders like to see that a consumer can manage a variety of accounts. For example, a mortgage, vehicle loan and a few revolving accounts will contribute to a healthy score. This particular category makes up 10% of your score.

- Inquiries, or applications for new credit, make up the last 10% of your credit score. It is wise to limit applications for new credit in a short period of time, so that you don’t pose a risk to lenders.

By having a full understanding of what makes up a credit score, you can take steps to maximize your credit. Knowledge is power!